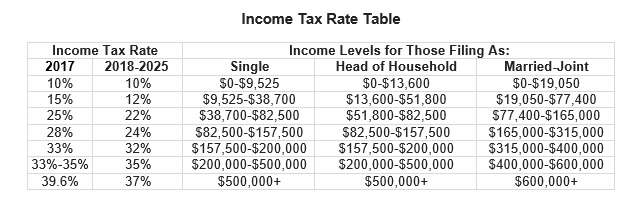

Tax Cuts and Jobs Act of 2017

In light of the developments surrounding 2018 Tax Cuts and Jobs Act, which was recently passed into law, below are the major changes that will affect a majority taxpayers' 2018 Tax Returns that will be filed in 2019. Please note that many of the changes will become effective on or after January 1, 2018 and will not affect your 2017 tax return.

NOTE: Because of the significant changes to the Standard Deduction and limit on the state and local taxes itemized deduction, many deductions may no longer be useful to your tax return. Taxpayers can choose to use the Standard Deduction or Itemize Deductions to help lower their taxable income. With the new higher standard deductions, many taxpayers may be able to lower their taxes more by using the standard deduction, even though they usually itemize. As a result, itemized deductions for taxes, interest and contributions, etc, may not be able to be used.